I try to remain as non-partisan as possible, but this election outcome does have an impact on your taxes.

Earlier this month, major news outlets officially announced the House of Representatives will be

maintained by Republicans. This means Republicans will have an executive and legislative trifecta when

it comes to re-assessing and re-writing tax law – which needs to be done by the end of 2025 or current

tax law will expire.

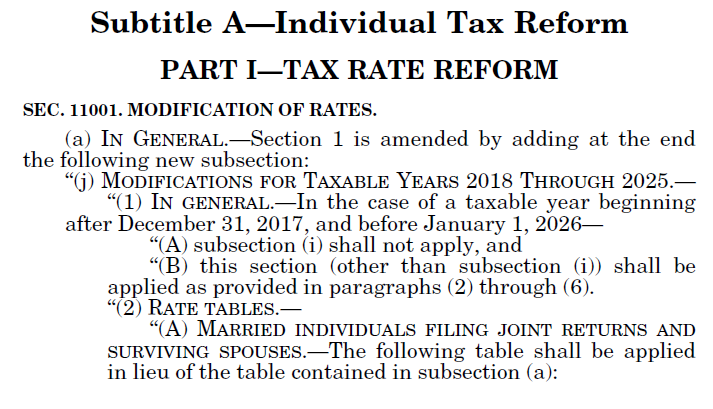

When Republicans controlled the executive and legislative branches in 2017, they passed the Tax Cuts

and Jobs Act, which gave us the primary tax code that we see today. The changes are too numerous to

detail in this short email, but there are 4 themes that jumped out from that change back in 2017:

- Higher Standard Deduction – Ultimately, this saved some taxes for many lower-and middle-

income taxpayers. However, it created an environment that made us need to be more strategic

with charitable giving in order to receive tax benefits. It also capped our state and local tax

deduction to $10,000 – which increased the tax burden on many upper-middle income

taxpayers. - Decreased corporate tax rate – Most of us are not directly affected on our tax returns by the

decreased corporate tax rate. HOWEVER, to make sure the corporate tax rate cut benefitted not

just corporations but also pass-through entities and sole proprietors — looking at you side-gig

worker and after-school private tutors — the QBI (qualified business income) deduction

emerged. In short, for most Americans, this translated to a 20% deduction for qualified business

income. If you’ve earned 1099 income in the past few years, you’ve likely benefited from the

QBI deduction. - Section 179 & Bonus Depreciation – Essentially, this allows businesses that are small enough to

expense property in the year of purchase rather than depreciate it. This means more tax savings

earlier on for many small businesses. There are substantially more details here, but this is the

main idea. - Higher Estate Tax Exemption – In 2017, the estate tax exemption (the amount of assets that can

get passed from a decedent to their heirs without incurring estate tax) was raised substantially

and indexed for inflation. In 2025, the estate tax exemption will be $13.99 million. This means

most Americans don’t have to worry about paying estate tax in the near-term and medium-term

future as this higher estate tax exemption will likely continue.

While we still need to see what new tax law will pass through Congress in 2025, for now, it likely will

involve more of the same. The Standard Deduction will likely stay high (a good thing for most people)

and tax rates will likely remain similar to what they’ve been over the past several years. Tax planning

probably doesn’t need to change too much for charitable givers. There are incentives to support small

business owners and 1099 income-earners. Further, the estate tax exemption will likely stay high, so for

most Americans, they won’t pay any estate tax upon their passing. However, executors of decedents

with surviving spouses will still want to elect DSUE portability on Form 706 to “lock-in” this higher estate

tax exemption for surviving spouses.

As always, if you have any questions and want to talk about tax planning, or if you know of someone

who might benefit from tax planning and preparation, don’t hesitate to reach out: ryan(at)ifptax.com